Three Steps to Success When Buying a Home This Spring

Three Steps to Success When Buying a Home This Spring

Posted on March 16, 2016

Mortgage rates are very low and home prices are stable or rising in the San Joaquin Valley, so to get a leg up on the home buying competition Self-Help Enterprises recommends prospective homebuyers follow three simple rules to help make one of the biggest purchases you make go smoothly.

- Consult a housing counselor for a homebuyer check-up

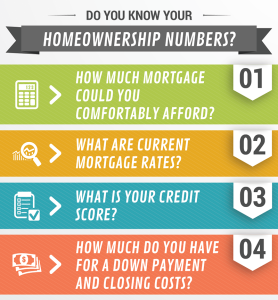

You don’t want to search for a home unprepared. Knowing the numbers that matter when buying a home is extremely important to save time, frustration and lead to the best choice. More than two-thirds of consumers in a NeighborWorks America survey said that the home buying process is complicated. Demystify the process and by consulting with one of Self-Help Enterprises’ housing counselors. Our staff are certified professionals who could walk you through the different types of mortgages and interest rates; the effect credit scores have on being approved for a loan, how much down payment is needed for purchase, and how much home is really affordable.

- Build a budget

Knowing your numbers is one thing, having the roadmap to get you there is another. There’s no better tool to chart your course than with a budget. National surveys have shown that less than one-third of consumers have a budget. Going into this home buying season with a budget that includes potential changes in commuting costs after purchase, home maintenance expenses, and even estimates for changes in life circumstances such as becoming a parent or paying for college, will give you a leg-up on the competition and provide peace of mind.Once all the numbers are on the table, it’s easier to see what type of home suits a family’s budget and needs, what might be necessary financial trade-offs, and what could be a direct line to trouble. - Be determined and informed

Finding the right mortgage and the right home takes time, and it’s natural to want to shorten the process. However, making a winning bid on a home that isn’t right, and cutting corners to do so, could lead to trouble. For example, forgoing a home inspection to speed things up, or not fully understanding the terms of the mortgage are ingredients for problems down the road.

Following these three tips will help ensure homeownership success this season and for the long run. To see an animated video describing more about the numbers to know, go here.

Recent Posts

Recent Comments

Archives

- June 2025

- May 2025

- April 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- April 2024

- February 2024

- January 2024

- December 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- December 2022

- October 2022

- September 2022

- August 2022

- July 2022

- May 2022

- December 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- February 2015